people's pension higher rate tax relief

Aug 30 2022. Higher-rate taxpayers can again claim higher rate tax relief through their tax returns under the UK self-assessment regime.

Tuesdays Cabinet meeting did not consider relief measures for household electricity users a source at Government House revealed.

. Aliens who are required to file a US. Thailands energy consumption surges in first seven months pointing to recovery. If you pay tax at 40 and you can claim it at this rate then it will reduce your tax by 40 100 x 40.

Exports and certain services to non-residents are taxed at a zero rate. Prior to the 19th century few formal charitable organizations existed to assist people in need. An annuity is an insurance product that allows you to swap your pension savings for a guaranteed regular income that will last for the rest of your life.

The Age Credit for Canadians aged 65 and older was increased by a total of 2 000 in addition to the existing indexation and was claimed by almost 5 million seniors in 2012. The infection rate in districts bordering India is much higher than the rest of the country and testing remains limited. The positivity rate has reached 25 percent which is higher than the peaks in April 2021 23 percent and in August last year 24 percent.

Another change is the removal of the 55 tax on your remaining pension pot after you die. Our content on radio web mobile and through social media encourages conversation and the. House and Senate Republicans pitched a 746 million plan this summer to expand tax relief to counter inflation.

Give mums and dads their state pension credits back. You can find income tax rate information on GOVUK. However if you have higher and additional rate taxpayers and your scheme uses relief at source they will need to claim their full tax relief by completing a tax self-assessment.

A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. If youre an additional rate taxpayer ie you earn over 150000 per year and pay 45 tax on this portion you can only claim your 25 extra via a Self-Assessment tax return. Pension income splitting was introduced allowing eligible Canadians to split up to 50 percent of their eligible pension income with their spouse or common-law partner to reduce their overall family tax.

A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. What are people doing. Well claim tax relief at the basic rate of 20 on your behalf and add it to your pension pot.

Leaving The Peoples Pension. Theres 1 form to fill in and return to us well then be in touch with more information on how you can send us your personal contributions by BACS. The applicable rate is 8.

The Salvation Army is one of the oldest and largest organizations working for disadvantaged people. People can easily disadvantage themselves under child benefit system. If the highest rate of tax that you pay is 20 or the relief is restricted to the standard rate then the claim of 100 will reduce your tax by 20 100 x 20.

How much you get is determined by the rate the annuity provider offers. If your staff pay income tax they will get tax relief whichever scheme you choose. Though it is a charity organization it has organized a number of volunteering programs since its inception.

Californias ad valorem property taxes may affect an individuals decision to move because longer ownership results in a lower effective property tax rate. The Treasurys OWN tax gurus want it to sort out child benefit mess. That means that you do not go back into the normal tax system - instead you pay tax at a rate of 40 on the amount by which your income exceeds your relevant exemption.

The IHT rate applied to death estates where the deceased leaves 10 or more of their estate to charity is reduced to 36 normally 40. You can leave at any time. Under the current rules if you die under the age of 75 your funds can be inherited tax free.

People who have serious health problems should be offered a higher rate than someone whos likely to live for many years. With a focus on Asia and the Pacific ABC Radio Australia offers an Australian perspective. An effective property tax rate differs from the 1 percent basic rate in that it is the amount of property taxes paid divided by the current market value of the property.

COVID-19 infection poses higher risk for myocarditis than vaccines. Consumption tax value-added tax or VAT is levied when a business enterprise transfers goods provides services or imports goods into Japan. If you were enrolled in The Peoples Pension but decided to leave.

But if you leave your employer may stop making payments to your pension as well. If you pay pension contributions via the net pay arrangement before tax has been taken youll receive your full 4045 straight away without having to do anything. As of 1 October 2019 the rate increased to 10.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Take the example of a claim of 100. Tax relief for households with children with disabilities BGN 143 mn.

Yonhap news articles produced by building a network covering domestic supplies in various newspapers broadcasting and government departments major institutions major corporations media K-pop K-wave Hallyu Korean Wave Korean pop Korean pop culture Korean culture Korean idol Korean movies Internet media and international agreements of the Republic of. The point at which marginal relief ceases to be of benefit varies with your family circumstances and the tax credits to which you are entitled. Youll only ever have one pension pot with us.

You pay Income Tax on your earnings before any pension contribution but the pension provider claims tax back from the government at the basic rate of 20. Disaster tax relief is available for those impacted by certain Presidentially declared disasters in 2021 see IRSgovDisasterTaxRelief. In the first few decades of the 20th century several volunteer organizations.

Effectively restricting their tax relief on pension contributions. Tax relief on personal pensions is normally paid directly by HM Revenue and Customs to the pension scheme at a rate of 20 of the gross contribution for anyone below the higher rate band. For more information see the Instructions for Form 1040 or the Instructions for Form 1040-NR.

If you die aged over 75 it can be passed on as a lump sum subject to income tax at your heirs personal rate. Copy and paste this code into your website. You dont have to be part of your workplace pension.

If youre a higher rate taxpayer you can claim the rest in your tax return. Income tax return may be affected. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Us Real Estate Blog Taxes

Personal Income Tax Brackets Ontario 2020 Md Tax

Income And Expense Statement Template Inspirational Statement Restaurant Financial Sampl Statement Template Personal Financial Statement Balance Sheet Template

People Who Plan To Live And Retire In South Africa Must Expand Their Investment Portfolios Says Jaco Annuity Retirement Investment Portfolio Financial Planner

20 Cheques Best Practices For Issuing And Handling Cheques Best Practice Practice Finance

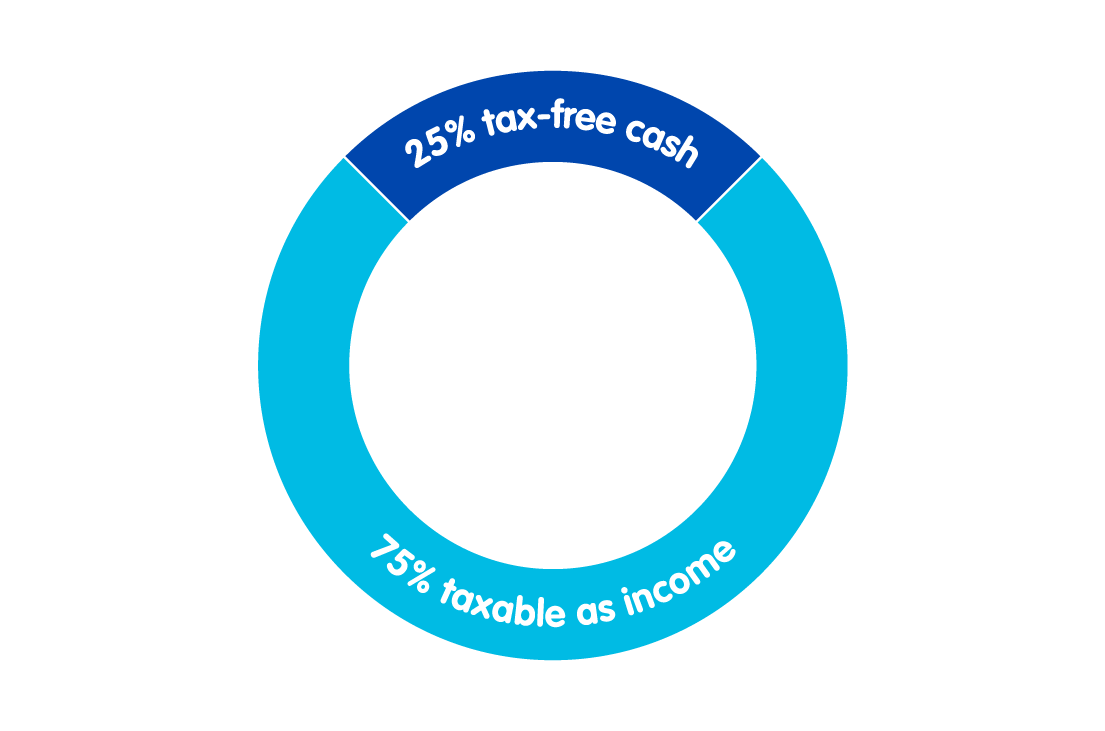

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Rsp Vs Rrsp The Difference Between Rsp And Rrsp In 2022 Personal Finance Blogs Retirement Savings Plan Saving For Retirement

Rrsp Contributions When S The Best Time To Use Your Deduction In 2022 Deduction Contribution Higher Income

6 Money Management Tips To Aid Your Startup Success Infographic Management Tips Money Management Finance

Disability Support Pension With Single Parent Fortnightly Payment 944 Maximum Family Tax Benefits A 242 20 Fam Public Knowledge Single Parenting Pensions

Which Budget Levers Can Osborne Pull After Pension Tax Rethink Budgeting Money Market Pensions

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement